Understanding the Alarming Reality of the US Debt Clock

`markdown

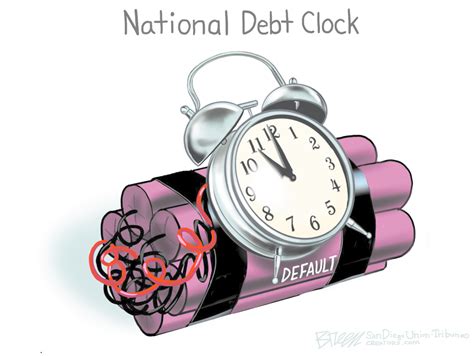

The US Debt Clock is more than just a website displaying numbers; it's a stark representation of the United States' mounting national debt, individual share of the debt, and other key financial metrics. In an era of increasing economic uncertainty, understanding what the US Debt Clock represents is crucial. This article delves into the intricacies of the US Debt Clock, exploring its significance, the underlying factors contributing to the debt, and potential implications for the future.

What is the US Debt Clock and Why Does it Matter?

The US Debt Clock is a real-time visual representation of the national debt of the United States. It dynamically displays figures like the total national debt, debt per citizen, debt per taxpayer, and various other economic indicators. Its purpose is to highlight the ever-increasing financial burden on the nation.

Why it matters: The US Debt Clock serves as a constant reminder of the growing debt crisis. It helps individuals understand the scale of the problem and encourages conversations about fiscal responsibility and the need for sustainable economic policies. The ever-rising numbers can be alarming, prompting a deeper examination of the causes and consequences of the national debt.

Factors Contributing to the Growing US Debt

Several factors contribute to the US's increasing national debt, some of which include:

- Government Spending: Increased government spending on social programs, defense, and infrastructure projects often exceeds revenue.

- Tax Cuts: Significant tax cuts without corresponding spending reductions can lead to a decrease in government revenue.

- Economic Recessions: During economic downturns, government spending typically increases to stimulate the economy, while tax revenue declines due to job losses and reduced economic activity.

- Interest Payments on Existing Debt: As the national debt grows, the government must allocate a larger portion of its budget to pay interest on that debt.

- Unfunded Liabilities: Obligations like Social Security and Medicare, which have projected future costs exceeding anticipated revenue, contribute significantly to the long-term debt picture.

- Increased Interest Rates: As the government borrows more money, it can drive up interest rates, making it more expensive for businesses and individuals to borrow.

- Inflation: Excessive government spending and borrowing can lead to inflation, reducing the purchasing power of the dollar.

- Reduced Economic Growth: High debt levels can crowd out private investment and hinder economic growth.

- Risk of Financial Crisis: An unsustainable debt burden can increase the risk of a financial crisis, potentially leading to economic instability.

- Burden on Future Generations: Future generations will be responsible for paying off the national debt, potentially impacting their economic opportunities.

- Total National Debt: This is the total amount of money owed by the US government to its creditors.

- Debt per Citizen: This represents the amount of national debt attributed to each US citizen.

- Debt per Taxpayer: This represents the amount of national debt attributed to each US taxpayer.

- Unfunded Liabilities: This figure represents the difference between the projected future costs of government programs and the anticipated revenue to cover those costs.

- Fiscal Responsibility: Implementing responsible budgeting practices, including controlling government spending and increasing revenue through fair taxation.

- Economic Growth: Fostering sustainable economic growth through policies that encourage investment, innovation, and job creation.

- Entitlement Reform: Addressing the long-term sustainability of Social Security and Medicare through reforms that balance benefits and costs.

- Debt Management: Developing a comprehensive debt management strategy that focuses on reducing the national debt over time.

- [Link to a past article about US Fiscal Policy]

- [Link to a past article about Economic Indicators]

Implications of a High National Debt

A high national debt can have several negative consequences, including:

Analyzing Key Figures on the US Debt Clock

The US Debt Clock presents a variety of important figures, including:

Understanding these figures provides a clearer picture of the financial challenges facing the United States.

Potential Solutions and Mitigation Strategies

Addressing the US national debt requires a multifaceted approach:

The Future and the US Debt Clock

The US Debt Clock will likely continue to tick upwards unless significant steps are taken to address the underlying causes of the national debt. The future economic outlook of the United States depends on the choices made today regarding fiscal policy and economic management. It is imperative that policymakers and citizens alike understand the implications of the US Debt Clock and work towards a more sustainable financial future.

Related Articles

Consider reading these related articles for a more complete understanding:

FAQ about the US Debt Clock

Q: What is the US Debt Clock?

A: The US Debt Clock is a real-time visual representation of the United States' national debt and other related economic indicators.

Q: Where does the US Debt Clock get its data?

A: The US Debt Clock gets its data from various government sources, including the US Treasury Department, the Bureau of Economic Analysis, and the Congressional Budget Office.

Q: Is the US Debt Clock accurate?

A: The US Debt Clock aims to provide an accurate representation of the national debt based on publicly available data. However, the figures are constantly changing, so the clock's numbers are always an estimate.

Q: What can I do about the US national debt?

A: You can stay informed about the issue, advocate for responsible fiscal policies, and support candidates who prioritize debt reduction.

Q: What are the dangers of the increasing national debt?

A: The increasing national debt can lead to higher interest rates, inflation, reduced economic growth, and a burden on future generations.

`