Unlocking Bitcoin: How Does Bitcoin Work and Why It Matters

`markdown

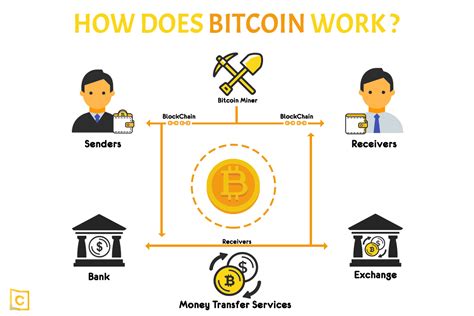

Preview: Ever wondered how does Bitcoin work? This comprehensive guide breaks down the complexities of Bitcoin, from its underlying technology to its potential impact on the future of finance. We'll explore the blockchain, mining, transactions, and everything you need to understand this revolutionary cryptocurrency.

How Does Bitcoin Work? A Deep Dive

How does Bitcoin work? That's the question on many people's minds as this cryptocurrency continues to gain traction. This article will provide a clear, concise, and comprehensive explanation of the inner workings of Bitcoin, focusing on its key components and functionalities. We'll delve into the intricacies of the blockchain, the process of mining, and the mechanics of Bitcoin transactions.

Understanding the Blockchain: The Foundation of Bitcoin

The blockchain is the core technology that makes Bitcoin possible. It's a distributed, public ledger that records all Bitcoin transactions in a secure and transparent manner. Think of it as a digital record book that is shared across a network of computers.

- Decentralization: Unlike traditional financial systems controlled by central authorities, the blockchain is decentralized. This means no single entity controls the network, making it resistant to censorship and manipulation.

- Blocks: Transactions are grouped together into "blocks." Each block contains a timestamp and a cryptographic hash of the previous block, creating a chain of blocks – hence the name "blockchain."

- Immutability: Once a block is added to the blockchain, it's virtually impossible to alter or delete. This immutability ensures the integrity and security of the transaction history.

- Proof-of-Work (PoW): Bitcoin uses a Proof-of-Work consensus mechanism. This requires miners to expend significant computational power to solve the mathematical problems, making it expensive and difficult to attack the network.

- Incentive Mechanism: The reward for mining new blocks incentivizes miners to maintain the integrity of the blockchain and secure the network.

- Difficulty Adjustment: The difficulty of the mathematical problems is automatically adjusted to maintain a consistent block creation rate, regardless of the number of miners participating in the network.

- Digital Signatures: Bitcoin transactions are secured using digital signatures. A digital signature is a cryptographic code that verifies the authenticity of a transaction and ensures that it hasn't been tampered with.

- Public and Private Keys: Users have a public key, which is like a bank account number, and a private key, which is like a password. The private key is used to sign transactions, while the public key is used to verify the signature.

- Transaction Fees: Bitcoin transactions typically involve a small fee, which is paid to the miners for processing the transaction. The fee can vary depending on the network congestion and the size of the transaction.

- Scalability: Bitcoin's transaction processing capacity is limited, which can lead to delays and higher fees during periods of high demand.

- Volatility: Bitcoin's price is highly volatile, making it a risky investment.

- Regulation: The regulatory landscape surrounding Bitcoin is still evolving, and unclear regulations could hinder its adoption.

- The blockchain is a distributed, public ledger that records all Bitcoin transactions.

- Bitcoin mining is the process of verifying and adding new transactions to the blockchain.

- Bitcoin transactions are secured using digital signatures.

- Bitcoin has the potential to revolutionize the financial industry, but it also faces challenges.

Mining Bitcoin: Creating New Blocks and Securing the Network

Bitcoin mining is the process of verifying and adding new transactions to the blockchain. Miners use powerful computers to solve complex mathematical problems. The first miner to solve the problem gets to add the next block to the blockchain and is rewarded with newly minted Bitcoin.

Bitcoin Transactions: Sending and Receiving Digital Currency

Bitcoin transactions are the process of transferring Bitcoin from one user to another. Each transaction is verified by the network and added to the blockchain.

The Future of Bitcoin: Potential and Challenges

Bitcoin has the potential to revolutionize the financial industry by providing a decentralized, secure, and transparent means of exchanging value. However, it also faces challenges, including:

Understanding Bitcoin: Key Takeaways

Here's a quick recap of the key points discussed:

FAQ: How Does Bitcoin Work?

Q: What is Bitcoin?

A: Bitcoin is a decentralized digital currency, meaning it's not controlled by any single entity like a bank or government. It uses cryptography for security and operates on a technology called the blockchain.

Q: How does Bitcoin work in simple terms?

A: Think of Bitcoin as digital cash. Transactions are recorded on a public ledger (the blockchain). Miners verify these transactions, adding them to the blockchain and earning Bitcoin as a reward.

Q: Is Bitcoin safe?

A: Bitcoin itself is considered relatively secure due to the blockchain technology and cryptographic principles it employs. However, individual wallets and exchanges can be vulnerable to hacking.

Q: How can I buy Bitcoin?

A: You can buy Bitcoin on cryptocurrency exchanges like Coinbase, Binance, and Kraken.

Q: What are the risks of investing in Bitcoin?

A: The main risks include price volatility, regulatory uncertainty, and the potential for hacking or scams.

In conclusion

How does Bitcoin work? Hopefully, this guide has provided a clear understanding of the fundamental concepts. While Bitcoin is complex, understanding its core principles is essential for anyone interested in the future of finance and technology. Remember to do your own research and consult with financial professionals before making any investment decisions.

`