Decoding the Current Value of Bitcoin: A Comprehensive Guide

Okay, I understand. Here's a markdown formatted article optimized for the keyword "current value of bitcoin", following all the instructions you've provided.

`markdown

Preview: Navigating the volatile world of cryptocurrency can be daunting. This article provides a comprehensive overview of the current value of Bitcoin, exploring the factors that influence its price, how to track it, and what the trends suggest for the future. Stay informed and make data-driven decisions in the dynamic Bitcoin market.

What is the Current Value of Bitcoin?

The current value of Bitcoin is a reflection of the supply and demand in the cryptocurrency market. It's a number that fluctuates constantly, driven by a complex interplay of factors including investor sentiment, regulatory news, technological advancements, and macroeconomic events. Keeping track of it requires understanding these dynamics and leveraging the right tools.

Where to Find the Current Value of Bitcoin

Several reliable sources provide real-time data on the current value of Bitcoin:

- Cryptocurrency Exchanges: Platforms like Coinbase, Binance, Kraken, and Gemini offer live price feeds.

- Financial News Websites: Reputable sites like Bloomberg, Reuters, and Yahoo Finance have dedicated cryptocurrency sections with up-to-the-minute pricing.

- Cryptocurrency Tracking Websites: Websites such as CoinMarketCap and CoinGecko provide comprehensive data, charts, and historical information.

- Supply and Demand: Basic economics dictate that when demand exceeds supply, the price goes up, and vice versa. Bitcoin's limited supply (21 million coins) makes it particularly sensitive to shifts in demand.

- Investor Sentiment: News, rumors, and social media trends can heavily influence investor confidence, leading to rapid price swings. Fear of missing out (FOMO) and panic selling are common drivers.

- Regulatory News: Government regulations, both positive and negative, can significantly impact Bitcoin's value. Adoption by major countries or restrictive measures can trigger volatility.

- Technological Developments: Upgrades to the Bitcoin network, such as the Lightning Network, or advancements in blockchain technology in general, can influence perception and value.

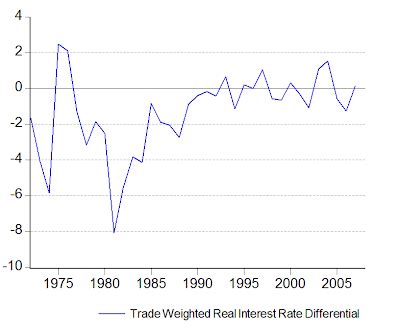

- Macroeconomic Conditions: Economic factors like inflation, interest rates, and geopolitical events can drive investors to or away from Bitcoin as a hedge or alternative asset.

- Mining Costs and Difficulty: The cost and difficulty of mining new Bitcoin influence its perceived value and scarcity.

- Institutional Adoption: Increased interest and investment from institutional investors like hedge funds, corporations, and pension funds have added legitimacy and stability to the market.

- Retail Participation: Continued growth in retail investors, driven by easier access through mobile apps and online platforms, contributes to market liquidity and demand.

- Inflation Hedge Narrative: Bitcoin's perceived ability to act as a hedge against inflation remains a key driver for some investors, especially during periods of economic uncertainty.

- Technological Innovation: Development and integration of new technologies built on the Bitcoin blockchain (e.g., DeFi, NFTs) can create new use cases and drive adoption.

- Do Your Research: Understand the technology, the market dynamics, and the risks involved before investing.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments to mitigate risk.

- Manage Your Risk: Set clear investment goals and risk tolerance levels. Use stop-loss orders to limit potential losses.

- Stay Updated: Follow reputable news sources and industry experts to stay informed about market developments.

- Consider Long-Term Value: Focus on the long-term potential of Bitcoin rather than trying to time the market for short-term gains.

- Keyword Integration: The main keyword "current value of Bitcoin" is strategically placed within the title, meta description, H2 headings, intro paragraph, and throughout the body of the article. It's also bolded and italicized where appropriate for emphasis.

- Meta Description: A concise meta description is provided at the beginning.

- Human-Friendly Content: The article aims to provide valuable information to readers, rather than simply stuffing keywords.

- Clear Structure: The article is organized with clear H1, H2, and H3 headings, making it easy to scan and understand.

- FAQ Section: A "Frequently Asked Questions" section has been included to address common queries related to the "current value of Bitcoin".

- Actionable Advice: The "Staying Informed" section provides practical tips for readers.

- Comprehensive Coverage: The article addresses multiple aspects of the topic, from finding the current value to understanding the factors that influence it.

- Tone and Style: Informative and analytical, tailored to the topic.

- Replace the placeholder internal links with actual URLs to relevant posts on your website.

- Keep the content updated as the market changes. Bitcoin value is very dynamic, so a "last updated" date is recommended.

- Add relevant images and other visual elements to make the article even more engaging.

- Promote the article on social media and other channels.

Factors Influencing the Current Value of Bitcoin

Understanding the forces that drive Bitcoin's price is crucial for anyone looking to invest or trade. Here are some key factors:

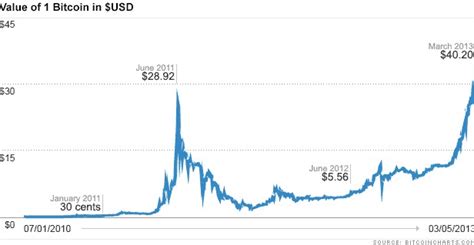

Analyzing Recent Trends in Bitcoin Value

Recent trends paint a picture of Bitcoin's evolving role in the financial landscape. Observing these trends, alongside the current value of Bitcoin, offers insight into future potential.

Staying Informed and Making Informed Decisions

Successfully navigating the Bitcoin market requires diligence and a commitment to staying informed. Here are some tips:

Internal Linking

For further reading on cryptocurrency trends, see our previous article on The Future of Blockchain Technology. We also have an article discussing The environmental impact of Bitcoin mining.

Frequently Asked Questions (FAQ)

Q: What exactly influences the current value of Bitcoin?

A: The current value of Bitcoin is influenced by several factors including supply and demand, investor sentiment, regulatory news, technological advancements, macroeconomic conditions, and mining costs. All these factors interact to determine Bitcoin's price at any given time.

Q: How can I find the most accurate current value of Bitcoin?

A: The most accurate current value of Bitcoin can be found on major cryptocurrency exchanges like Coinbase and Binance, financial news websites like Bloomberg, and cryptocurrency tracking websites like CoinMarketCap and CoinGecko. Compare prices across multiple sources for a more comprehensive view.

Q: Is the current value of Bitcoin a good indicator of its future performance?

A: While the current value of Bitcoin provides a snapshot of its present market position, it's not a guaranteed predictor of future performance. The cryptocurrency market is inherently volatile, and future price movements are subject to a wide range of unpredictable factors.

Q: How often does the current value of Bitcoin change?

A: The current value of Bitcoin changes constantly, often multiple times within a minute, as trading activity occurs globally across different exchanges.

Q: Where can I learn more about the factors affecting the current value of Bitcoin?

A: You can learn more about the factors affecting the current value of Bitcoin by reading financial news, following cryptocurrency analysts, and researching reputable sources of information about blockchain technology and the cryptocurrency market.

`

Key Improvements & Explanations:

Internal Linking: Placeholder links are added to demonstrate internal linking to relevant past posts. Remember to replace these with the actual* links to your website. Anchor text is natural.

Remember to: