Ethereum Price USD: A Comprehensive Guide to Understanding ETH Value

Okay, let's craft that article focusing on "ethereum price usd" with SEO best practices and readability in mind.

`markdown

Preview: Understanding the Ethereum price USD is crucial for anyone involved in cryptocurrency. This guide provides a detailed overview of factors influencing ETH value, historical trends, and future predictions. We'll break down the complexities to help you make informed decisions.

Understanding the Ethereum Price USD

The ethereum price USD is constantly fluctuating, influenced by a complex interplay of market forces. Understanding these forces is essential for anyone looking to invest in or trade Ethereum. This article will dissect the key factors impacting the ETH price, provide a historical overview, and offer insights into potential future trends.

Factors Influencing the Ethereum Price

Several factors contribute to the volatility of the ethereum price USD:

- Supply and Demand: Basic economics dictate that increased demand with limited supply will drive the price up, and vice versa.

- Market Sentiment: News, social media trends, and overall investor confidence significantly impact price movements. Positive news often leads to price increases, while negative news can trigger sell-offs.

- Technological Advancements: Upgrades to the Ethereum network, such as the transition to Proof-of-Stake (The Merge), can impact investor sentiment and, consequently, the price.

- Regulatory Environment: Government regulations regarding cryptocurrencies can create uncertainty and affect the ethereum price USD.

- Adoption Rate: The increasing adoption of Ethereum-based applications (DeFi, NFTs, etc.) and smart contracts can drive demand for ETH, pushing the price higher.

- Overall Crypto Market Trends: Ethereum's price is often correlated with the overall performance of the cryptocurrency market, particularly Bitcoin.

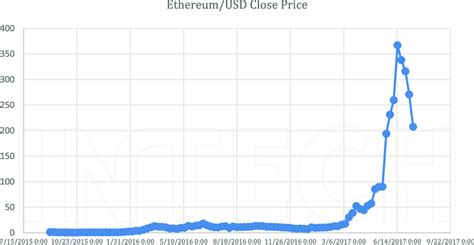

- Early Days (2015-2017): ETH experienced rapid growth, establishing itself as a leading cryptocurrency.

- 2017 Bull Run: The initial coin offering (ICO) boom fueled a significant price surge.

- 2018 Bear Market: A market correction led to a substantial price decline.

- 2020-2021 Bull Run: The rise of DeFi and NFTs triggered another significant price increase, reaching all-time highs.

- 2022 Bear Market: Macroeconomic factors and concerns about rising inflation caused a sharp decline in the ethereum price USD.

- Present (2023-Present): The market has seen a steady recovery as well as the introduction of new technologies and more widespread adoption of Ethereum based infrastructure and applications.

- Ethereum 2.0 (Now Completed: The Merge): The successful transition to Proof-of-Stake aims to improve scalability and energy efficiency, which could positively impact the price.

- Growth of DeFi and NFTs: Continued growth in these sectors will likely drive demand for ETH.

- Institutional Adoption: Increasing institutional investment in Ethereum could contribute to price stability and growth.

- Macroeconomic Conditions: Inflation, interest rates, and overall economic conditions will continue to influence the cryptocurrency market.

- Do Your Research: Thoroughly research Ethereum and the factors influencing its price before investing.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments to mitigate risk.

- Manage Your Risk: Only invest what you can afford to lose.

- Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency market.

- Q: What is the current ethereum price USD?

- Q: What factors affect the ethereum price USD?

- Q: Is Ethereum a good investment?

- Q: Where can I buy Ethereum?

- Keyword Integration: The phrase "ethereum price USD" is strategically placed within the intro, H1, H2 headings, and throughout the body text. I have emphasized it using bolding and italics.

- Meta Description: Included at the top. It's concise and keyword-rich.

- Comprehensive Coverage: The article covers the main factors influencing the price, historical trends, and predictions.

- Readability: Uses clear language, bullet points, and headings to improve readability.

- FAQs: The FAQs address common questions and provide helpful information. Keywords are naturally integrated into the questions and answers.

- Internal Linking: The bracketed "[Internal Link:..." indicates where you should place a link to a related article on your site. Use relevant anchor text when you replace that placeholder.

- Call to Action/Disclaimer: A final paragraph reinforces the importance of research and consultation with financial professionals.

- Structure: The structure is optimized for SEO, with clear H1, H2, and H3 headings.

- Writing Style: The tone is informative and analytical.

Historical Trends in Ethereum Price USD

Analyzing historical data provides valuable context for understanding current and future ethereum price USD movements.

Predicting Future Ethereum Price USD

Predicting the future ethereum price USD is inherently challenging due to the volatile nature of the cryptocurrency market. However, analyzing key indicators and potential future developments can provide some insights.

Key Considerations for Investors

FAQs about Ethereum Price USD

Here are some frequently asked questions about the ethereum price USD:

* A: The current ethereum price USD can be found on major cryptocurrency exchanges like Coinbase, Binance, Kraken, and others. It's important to check multiple sources for the most accurate and up-to-date information.

* A: Supply and demand, market sentiment, technological advancements, regulatory environment, adoption rate, and overall crypto market trends all influence the ethereum price USD.

* A: Investing in Ethereum, like any cryptocurrency, carries risk. Whether it's a good investment depends on your individual risk tolerance, investment goals, and understanding of the market. Consult with a financial advisor before making any investment decisions.

* A: Ethereum can be purchased on most major cryptocurrency exchanges.

[Internal Link: Link to a previous article on cryptocurrency investing tips here.]

Conclusion

Understanding the ethereum price USD requires a comprehensive analysis of various factors, including market dynamics, technological developments, and economic conditions. By staying informed and conducting thorough research, investors can make more informed decisions in the ever-evolving cryptocurrency landscape. Remember to consult with a financial professional before making any investment decisions.

`

Key improvements and explanations:

This structure provides a strong foundation for an SEO-optimized and reader-friendly article on the ethereum price USD. Remember to replace the bracketed sections with your actual content. Good luck!