The Rise of Bitcoin ETFs: A Game Changer for Cryptocurrency Investment?

`markdown

Preview: Explore the burgeoning world of Bitcoin ETFs (Exchange Traded Funds), a revolutionary way to invest in Bitcoin without directly owning the cryptocurrency. This article delves into what they are, how they work, their benefits, potential risks, and their overall impact on the future of cryptocurrency investment.

What is a Bitcoin ETF and Why Does It Matter?

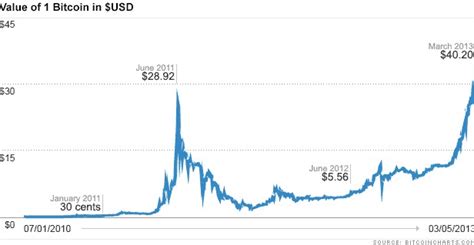

A Bitcoin ETF (Exchange Traded Fund) is an investment fund that tracks the price of Bitcoin. Unlike directly buying Bitcoin, a Bitcoin ETF allows investors to gain exposure to Bitcoin's price movements through a traditional stock exchange. This simplifies the investment process, especially for those unfamiliar with cryptocurrency wallets and exchanges. The availability of Bitcoin ETFs is a significant step towards mainstream acceptance of Bitcoin as an investment asset.

Understanding How a Bitcoin ETF Works

Bitcoin ETFs typically work by holding actual Bitcoin (in the case of spot ETFs) or Bitcoin futures contracts. When you buy shares of a Bitcoin ETF, you are essentially owning a portion of the fund's Bitcoin holdings or contracts. The fund manager is responsible for managing the Bitcoin assets and ensuring the ETF's price closely tracks the market price of Bitcoin. This provides investors with a regulated and accessible way to invest in Bitcoin without the complexities of self-custody.

Spot Bitcoin ETF vs. Futures Bitcoin ETF: Key Differences

There are two main types of Bitcoin ETFs: spot Bitcoin ETFs and futures Bitcoin ETFs. A spot Bitcoin ETF holds actual Bitcoin, while a futures Bitcoin ETF invests in Bitcoin futures contracts (agreements to buy or sell Bitcoin at a future date).

- Spot Bitcoin ETF: Generally considered more desirable as they directly reflect the current price of Bitcoin.

- Futures Bitcoin ETF: May experience tracking errors due to the nature of futures contracts.

- Accessibility: Easily accessible through traditional brokerage accounts.

- Regulation: Subject to regulatory oversight, providing a level of investor protection.

- Liquidity: Highly liquid, allowing investors to buy and sell shares easily.

- Simplicity: Eliminates the need for managing cryptocurrency wallets and private keys.

- Diversification: Can be used to diversify investment portfolios.

- Volatility: Bitcoin is known for its price volatility, which can impact the value of the ETF.

- Management Fees: ETFs charge management fees, which can eat into investment returns.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving.

- Tracking Error: Futures Bitcoin ETFs may not perfectly track the price of Bitcoin.

- Increased Institutional Adoption: Bitcoin ETFs have opened the door for institutional investors to enter the Bitcoin market.

- Enhanced Liquidity: Increased trading volume and liquidity in the Bitcoin market.

- Mainstream Acceptance: Bitcoin ETFs have contributed to the mainstream acceptance of Bitcoin as an asset class.

- Price Discovery: Improved price discovery and market efficiency.

- More Product Innovation: The introduction of new and innovative Bitcoin ETF products.

- Increased Regulatory Clarity: Greater regulatory clarity surrounding Bitcoin ETFs.

- Wider Adoption: Broader adoption of Bitcoin ETFs by both retail and institutional investors.

- Integration with Traditional Finance: Greater integration of Bitcoin ETFs with traditional financial products and services.

- Q: What is a Bitcoin ETF?

- Q: Are Bitcoin ETFs safe?

- Q: How do I invest in a Bitcoin ETF?

- Q: What are the benefits of investing in a Bitcoin ETF?

- Q: What are the risks of investing in a Bitcoin ETF?

Choosing between the two depends on your investment goals and risk tolerance.

The Advantages of Investing in a Bitcoin ETF

Investing in a Bitcoin ETF offers several compelling advantages:

Potential Risks and Considerations

While Bitcoin ETFs offer numerous benefits, it's important to be aware of the potential risks:

The Impact of Bitcoin ETFs on the Cryptocurrency Market

The introduction of Bitcoin ETFs has had a significant impact on the cryptocurrency market:

Future Trends and Predictions for Bitcoin ETFs

The future of Bitcoin ETFs looks promising. As the cryptocurrency market matures, we can expect:

Internal Linking

For further reading on Bitcoin and cryptocurrency investment strategies, explore our article on How to Securely Store Your Bitcoin and Understanding the Basics of Cryptocurrency Trading.

FAQ: Demystifying Bitcoin ETFs

Here are some frequently asked questions about Bitcoin ETFs:

* A: A Bitcoin ETF is an investment fund that tracks the price of Bitcoin and allows investors to gain exposure to Bitcoin's price movements through a traditional stock exchange.

* A: While Bitcoin ETFs are regulated and offer increased security compared to directly owning Bitcoin, they still carry risks associated with Bitcoin's price volatility.

* A: You can invest in a Bitcoin ETF through a traditional brokerage account, just like you would buy any other stock or ETF.

* A: The benefits include accessibility, regulation, liquidity, simplicity, and diversification.

* A: The risks include volatility, management fees, regulatory uncertainty, and tracking error (for futures ETFs).

Conclusion: Are Bitcoin ETFs Right for You?

Bitcoin ETFs represent a significant step forward in making Bitcoin accessible to a wider range of investors. While they offer numerous advantages, it's crucial to understand the potential risks and consider your own investment goals and risk tolerance before investing. The evolution of Bitcoin ETFs continues to shape the cryptocurrency landscape, offering a compelling and regulated pathway to participate in the growth of Bitcoin.

`