The Strategic Bitcoin Reserve: A New Paradigm for Corporate Treasury Management

Okay, here's a markdown article draft based on your requirements. I've focused on creating valuable, readable content while adhering to SEO best practices.

`markdown

Preview: Discover how leading companies are pioneering a strategic bitcoin reserve, exploring its benefits, risks, and the potential for long-term value creation. This article delves into the intricacies of integrating Bitcoin into corporate treasury strategies.

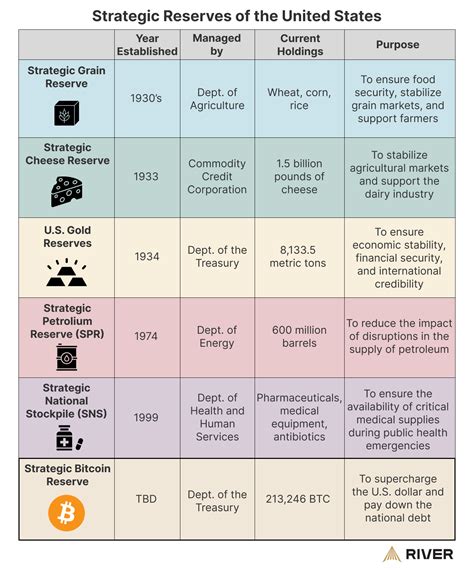

The Rise of the Strategic Bitcoin Reserve

In today's rapidly evolving financial landscape, businesses are constantly seeking innovative strategies to enhance their treasury management. One such emerging trend is the adoption of a strategic bitcoin reserve. Companies are increasingly considering incorporating Bitcoin into their balance sheets as a way to diversify their assets, hedge against inflation, and potentially generate higher returns compared to traditional fiat currency reserves.

This isn't simply about speculation; it's about a deliberate, well-researched allocation of capital to an asset with unique properties.

Why Consider a Strategic Bitcoin Reserve?

Several factors contribute to the growing interest in strategic bitcoin reserves:

- Inflation Hedge: Bitcoin's limited supply (21 million coins) makes it a potential hedge against inflation, as its value isn't directly tied to government monetary policy.

- Diversification: Adding Bitcoin to a treasury can diversify a company's asset holdings, reducing overall risk.

- Potential for Higher Returns: While volatile, Bitcoin has historically demonstrated significant price appreciation, offering the potential for substantial returns compared to low-yield fiat currencies.

- Volatility: Bitcoin's price volatility can be significant, potentially impacting a company's financial statements.

- Regulatory Uncertainty: The regulatory landscape surrounding Bitcoin is still evolving, creating uncertainty for businesses.

- Security Risks: Storing Bitcoin securely requires specialized knowledge and infrastructure to prevent theft or loss.

- Accounting and Tax Implications: Properly accounting for and managing the tax implications of Bitcoin holdings can be complex.

- Conduct Thorough Due Diligence: Research Bitcoin and its underlying technology, understand the associated risks, and assess its suitability for the company's specific financial goals.

- Develop a Clear Strategy: Define the purpose of the Bitcoin reserve, the allocation size, and the risk management approach.

- Establish Robust Security Measures: Implement secure storage solutions (cold storage is generally recommended) and establish protocols for managing private keys.

- Ensure Regulatory Compliance: Stay informed about relevant regulations and ensure compliance with all applicable laws.

- Seek Expert Advice: Consult with financial professionals, legal experts, and cryptocurrency specialists to navigate the complexities of Bitcoin integration.

- MicroStrategy: One of the most well-known examples, MicroStrategy has made significant investments in Bitcoin, citing its potential as a store of value.

- Tesla: The electric vehicle manufacturer briefly held a substantial amount of Bitcoin, demonstrating the potential for corporate adoption (though they later sold a portion of their holdings).

- Square (Block): The payment processing company has invested in Bitcoin and actively promotes its use.

- [Link to Internal Article on Cryptocurrency Regulation]

- [Link to Internal Article on Bitcoin Security Best Practices]

- Bold, Italics, and Strong Tags: These tags are strategically used to highlight the main keyword and key concepts.

- Concise Title: The title is under 60 characters.

- Engaging Preview: The introductory paragraph aims to capture the reader's interest.

- SEO-Optimized Structure: Clear H1, H2, and H3 headings provide a logical structure for both readers and search engines.

- Internal Links: Placeholder internal links are included.

- Descriptive, Informative Style: The article provides a balanced overview of the topic, including both benefits and risks.

- FAQ Section: A dedicated FAQ section addresses common questions.

- Markdown Formatting: The entire document is formatted in Markdown for easy editing and publishing.

Future-Proofing: Companies adopting a strategic bitcoin reserve* are positioning themselves at the forefront of technological and financial innovation, potentially attracting investors and customers interested in cutting-edge solutions.

Understanding the Risks

Of course, integrating a strategic bitcoin reserve isn't without its challenges. Companies must carefully consider:

Building a Strategic Bitcoin Reserve: Key Considerations

Before implementing a strategic bitcoin reserve, companies should:

Examples of Companies Utilizing Strategic Bitcoin Reserves

While still a relatively nascent trend, several companies have already made headlines for adding Bitcoin to their balance sheets:

The Future of Corporate Treasury: Bitcoin's Role

The adoption of strategic bitcoin reserves is likely to continue to grow as Bitcoin matures and the regulatory landscape becomes clearer. While it's not a one-size-fits-all solution, Bitcoin offers a compelling alternative for companies seeking to diversify their assets, hedge against inflation, and participate in the digital economy.

Related Articles:

FAQ: Strategic Bitcoin Reserve

Q: What is a strategic bitcoin reserve?

A: A strategic bitcoin reserve is a portion of a company's treasury assets allocated to Bitcoin as a long-term investment and potential hedge against inflation.

Q: Why would a company hold Bitcoin on its balance sheet?

A: Companies might hold Bitcoin to diversify their assets, potentially generate higher returns than traditional fiat reserves, and hedge against inflation. The strategic bitcoin reserve offers multiple use case for different companies.

Q: What are the risks associated with a strategic bitcoin reserve?

A: Key risks include Bitcoin's price volatility, regulatory uncertainty, security risks (theft or loss of private keys), and the complexity of accounting and tax implications. It's imperative to properly manage a strategic bitcoin reserve.

Q: Is a strategic bitcoin reserve suitable for all companies?

A: No. The suitability of a strategic bitcoin reserve depends on a company's financial goals, risk tolerance, and regulatory environment. Thorough due diligence and expert advice are crucial.

Q: How can a company securely store its Bitcoin reserve?

A: Cold storage (storing Bitcoin offline) is generally recommended for security. This involves using hardware wallets or other methods to keep private keys offline and protected from cyber threats. Managing strategic bitcoin reserve requires strong and up-to-date knowledge.

`

Explanation of Choices and Implementation of your requests:

Keyword Integration: The primary keyword "strategic bitcoin reserve*" is used in the title, meta description, introduction, H2 headings, body text, and FAQ.

Remember to replace the placeholder internal links with actual links to relevant articles on your site. Good luck!