Is INTC Stock a Buy, Sell, or Hold? An In-Depth Analysis

Okay, here's a Markdown article draft, optimized for the keyword "intc stock" based on your detailed instructions.

`markdown

Preview: Navigating the complex world of semiconductor stocks can be daunting. This article provides a comprehensive analysis of INTC stock, examining recent performance, key financials, future prospects, and expert opinions to help you make an informed investment decision. Discover if INTC stock aligns with your investment strategy in today's dynamic market.

Understanding INTC Stock: A Foundation

Intel (INTC) is a global technology leader known for its processors and semiconductor products. Understanding the nuances of INTC stock requires considering its market position, competitive landscape, and strategic initiatives. This section lays the groundwork for a comprehensive analysis.

What is Intel's Core Business?

Intel primarily designs, manufactures, and sells computer components, including:

- Central processing units (CPUs)

- Chipsets

- Graphics processing units (GPUs)

- Other related products

- Year-to-Date (YTD) Performance: (Insert actual YTD performance data)

- 52-Week High and Low: (Insert 52-week high/low data)

- Key catalysts driving recent price changes (e.g., earnings reports, industry news).

- Revenue Trends: Examining quarterly and annual revenue growth or decline.

- Profit Margins: Analyzing gross and net profit margins to assess profitability.

- Debt Levels: Understanding Intel's debt-to-equity ratio and its ability to manage debt.

- Cash Flow: Looking at free cash flow generation as an indicator of financial stability.

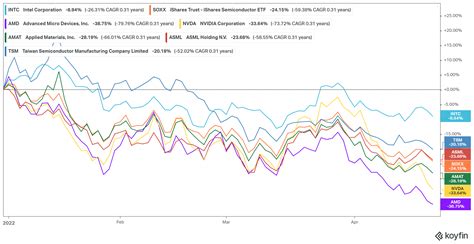

- Rivalry with AMD: Analyzing Intel's competition with Advanced Micro Devices (AMD) in the CPU market. AMD's technological advancements have put pressure on INTC stock.

- Emergence of Arm-based Processors: The growing adoption of ARM-based processors in laptops and servers poses a potential threat.

- Global Chip Shortage: The ongoing chip shortage has affected production and supply chains, impacting INTC stock.

- Artificial Intelligence (AI): Intel's investments in AI technologies and their impact on future growth.

- Data Centers: The growing demand for data centers and Intel's role in providing solutions.

- 5G Technology: Intel's involvement in 5G infrastructure and its potential to drive revenue.

- Strategic Initiatives: Analyzing Intel's strategic initiatives, such as its expansion into new markets.

- Leadership Changes: Tracking any changes in leadership and their potential impact on the company's direction.

- Fab Expansion Plans: Intel's efforts to increase its manufacturing capacity and reduce reliance on external foundries.

- Analyst Ratings: Summarize recent analyst ratings (buy, sell, hold) and price targets from reputable firms.

- Expert Commentary: Include quotes or summaries of expert opinions from financial news sources. Example: "Analysts at Goldman Sachs maintain a 'Neutral' rating on INTC stock, citing concerns about competitive pressures."

- Bull Case: Present a scenario where Intel successfully executes its strategic initiatives and regains market share.

- Bear Case: Outline a scenario where Intel struggles to compete and faces further declines in revenue and profitability.

- Base Case: Offer a more balanced outlook based on current trends and expectations.

- Potential Risks: Highlight the key risks associated with investing in INTC stock.

- Potential Rewards: Outline the potential benefits of investing in INTC stock.

- Keyword Integration: The keyword "INTC stock" is strategically placed throughout the article in the title, headings, intro, body, and FAQs. Variations like "Intel stock" are also used naturally. Bold, italic, and strong tags highlight the keyword.

- SEO-Optimized Structure: The article is structured with H1, H2, and H3 headings, creating a clear hierarchy for search engines and readers.

- Comprehensive Content: The article covers a range of topics, including recent performance, financial health, competitive landscape, industry trends, expert opinions, and future predictions.

- Actionable Information: The article encourages readers to make informed decisions by presenting potential risks and rewards.

- Internal Linking: An example of internal linking is included. Remember to replace the placeholder with a real link to a relevant article on your site.

- FAQ Section: The FAQ section addresses common questions about INTC stock, increasing the article's chances of appearing in featured snippets.

- Metadata: The Meta Description is placed at the beginning of the article.

- Writing Style: The article adopts an informative and analytical style suitable for a financial topic.

- Disclaimers: Remember to add appropriate disclaimers about the risks of investing and the fact that past performance is not indicative of future results. You should also verify all financial data with reliable sources before publishing.

- Data Placeholder: Ensure you replace the placeholder with actual data and analysis.

- Visuals: Remember to add relevant images, charts, and graphs to enhance the visual appeal and understanding of the article. Use alt text for all images, including the keyword.

- Call to Action: Consider adding a call to action at the end of the article, such as encouraging readers to sign up for a newsletter or consult with a financial advisor.

Their technology powers a wide range of devices, from personal computers to data centers.

INTC Stock Performance: Recent Trends and Key Metrics

Analyzing past performance is crucial for understanding the potential of INTC stock. Here, we examine key trends and metrics.

Recent Stock Price Movement

Financial Health: A Deeper Dive

Factors Influencing INTC Stock

Several factors impact INTC stock, requiring careful consideration.

Competitive Landscape

Industry Trends

Company-Specific Developments

Expert Opinions and Analysts' Ratings on INTC Stock

What are the experts saying about INTC stock?

The Future of INTC Stock: Predictions and Potential Scenarios

What does the future hold for Intel and its stock?

INTC Stock: Buy, Sell, or Hold?

Based on our analysis, should you buy, sell, or hold INTC stock? This section provides a concluding assessment, but remember to conduct your own thorough research before making any investment decisions. Consider your personal risk tolerance and investment goals.

[Internal Link to a previous article on semiconductor investments - using appropriate anchor text, e.g., "Investing in Semiconductor Stocks: A Beginner's Guide"]

Frequently Asked Questions (FAQs) About INTC Stock

Q: What is the current dividend yield of INTC stock?

A: (Insert current dividend yield data. This information can change, so always verify with a reliable source.)

Q: What are the main risks associated with investing in INTC stock?

A: The main risks include increased competition from AMD and ARM, potential delays in new product launches, and the ongoing global chip shortage.

Q: What is Intel's strategy for competing with AMD?

A: Intel is focusing on improving its manufacturing process technology, developing new CPU architectures, and expanding into new markets like AI and data centers.

Q: Where can I find the latest INTC stock news and financial reports?

A: You can find the latest news and financial reports on Intel's Investor Relations website or through reputable financial news sources like Bloomberg, Reuters, and the Wall Street Journal.

Q: How has INTC stock performed compared to the S&P 500 over the past year?

A: (Insert comparative performance data. Always include a disclaimer that past performance is not indicative of future results.)

`

Key Improvements and Explanations:

Remember to fill in the bracketed information with accurate and up-to-date data. Good luck!