Demystifying IRS Doge: Crypto, Taxes, and What You Need to Know

Okay, let's craft a well-optimized article about "IRS Doge."

`markdown

Is the IRS going after Dogecoin? Not exactly. But the convergence of cryptocurrency and tax law, often humorously referred to as "IRS Doge," is a serious matter for crypto investors. This article breaks down what you need to know about reporting crypto gains to the IRS and navigating the evolving regulatory landscape.

What is "IRS Doge" and Why Is It Trending?

The term "IRS Doge" playfully refers to the increasing scrutiny the Internal Revenue Service (IRS) is placing on cryptocurrency transactions. While Dogecoin is often used as a shorthand for cryptocurrency in general, the term implies a more serious undercurrent: the potential tax implications of owning, trading, and using digital assets.

The Rise of Crypto and IRS Attention

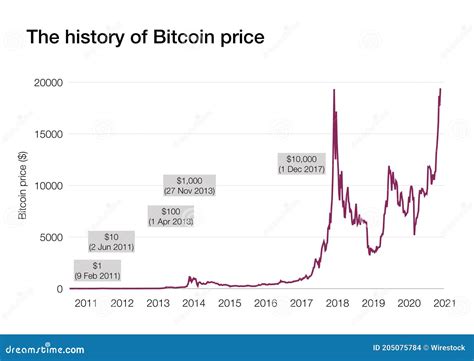

As cryptocurrency adoption has grown exponentially, so too has the IRS's interest. They're keen to ensure that crypto profits are properly reported and taxed. This is because cryptocurrencies, like stocks or real estate, are subject to capital gains taxes when sold at a profit.

How the IRS Treats Cryptocurrency

The IRS treats cryptocurrency as property, not currency. This distinction is important because it determines how crypto transactions are taxed.

- Buying Crypto: Not a taxable event.

- Selling Crypto: A taxable event. If you sell crypto for more than you bought it for, you have a capital gain. If you sell it for less, you have a capital loss.

- Trading Crypto for Crypto: A taxable event. Even if you're not converting crypto back to fiat currency (USD, EUR, etc.), trading one crypto for another is considered a sale and purchase, triggering potential capital gains taxes.

- Using Crypto to Buy Goods or Services: A taxable event. The IRS treats this as selling your crypto and then using the proceeds to buy something.

- Short-Term Capital Gains: Profits from assets held for one year or less. Taxed at your ordinary income tax rate.

- Long-Term Capital Gains: Profits from assets held for more than one year. Taxed at preferential rates (0%, 15%, or 20% depending on your income).

- Form 8949: Use this form to report your capital gains and losses from crypto transactions.

- Schedule D (Form 1040): Use this form to summarize your capital gains and losses and report them on your individual income tax return (Form 1040).

- Keep Detailed Records: Maintain accurate records of all your crypto transactions, including dates, amounts, purchase prices, and sale prices. This documentation is crucial in the event of an audit.

- IRS Notices and Rulings: Pay attention to official IRS announcements regarding cryptocurrency taxation.

- Tax Professionals: Consider consulting with a tax professional who specializes in cryptocurrency to ensure you are complying with all applicable laws and regulations.

Understanding Capital Gains and Losses with IRS Doge

Capital gains are the profits you make from selling an asset for more than you paid for it. Capital losses are the losses you incur when selling an asset for less than you paid for it.

Understanding whether you're dealing with short-term or long-term capital gains is crucial for accurate tax reporting when dealing with IRS Dogecoin implications.

Reporting Your Crypto Taxes

Accurately reporting your crypto taxes is essential to avoid penalties.

Navigating the Evolving Regulatory Landscape Surrounding IRS Doge

The regulatory landscape surrounding cryptocurrency is constantly evolving. The IRS is continually issuing new guidance and interpretations. Staying informed about these changes is crucial.

Key Takeaways: Don't Ignore the IRS Doge!

The IRS Doge meme represents a serious reality: cryptocurrency is subject to taxation. Understanding how the IRS treats crypto, keeping accurate records, and staying informed about regulatory changes are crucial for avoiding penalties and staying on the right side of the law.

Internal Linking to Other Content

For further information about tax preparation, see our article on Tax Preparation Checklist.

FAQ: IRS Doge Edition

Q: Is it illegal to own cryptocurrency?

A: No, owning cryptocurrency is not illegal. However, you are required to report any taxable events (such as selling or trading crypto for a profit) to the IRS.

Q: Will the IRS audit me if I own DogeCoin?

A: Owning Dogecoin or any other cryptocurrency doesn't automatically trigger an audit. However, failing to accurately report your crypto gains could increase your risk of an audit.

Q: What happens if I don't report my crypto gains to the IRS?

A: Failing to report your crypto gains can result in penalties, interest, and even criminal charges in severe cases. It's always best to be proactive and comply with tax laws.

Q: Where can I find more information about crypto taxes?

A: Consult with a tax professional who specializes in cryptocurrency or visit the IRS website for official guidance.

This markdown provides a comprehensive overview of the topic, incorporates the target keyword in a natural way, and addresses common questions surrounding the taxation of cryptocurrencies. Remember to replace "[URL to be inserted]" with an actual link to relevant internal content.

`