Decoding the USD to JPY Exchange Rate: A Comprehensive Guide

Okay, here's the article draft following your instructions.

`markdown

Preview: Understanding the dynamic relationship between the US Dollar (USD) and the Japanese Yen (JPY) is crucial for anyone involved in international finance, trade, or travel. This guide provides a comprehensive overview of the factors influencing the USD to JPY exchange rate and how to interpret market movements.

Understanding the Basics of USD to JPY

The USD to JPY exchange rate represents how many Japanese Yen (JPY) one US Dollar (USD) can buy. It's a vital indicator of economic health for both the United States and Japan and significantly impacts global trade. Fluctuations in this rate can affect everything from the price of Japanese imports in the US to the profitability of American companies exporting goods to Japan.

Factors Influencing the USD to JPY Rate

Several factors drive the fluctuations in the USD to JPY exchange rate. Understanding these factors is essential for predicting future movements:

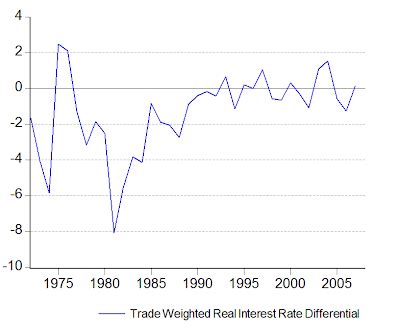

- Interest Rate Differentials: The difference in interest rates set by the US Federal Reserve (the Fed) and the Bank of Japan (BOJ) is a primary driver. Higher US interest rates tend to attract investment, increasing demand for the USD and thus strengthening the USD to JPY rate. Conversely, higher Japanese rates would favor the JPY.

- Economic Growth: Strong economic growth in the US generally supports a stronger USD. Conversely, strong growth in Japan supports the JPY. Relative growth rates are key.

- Inflation: Higher inflation in the US relative to Japan can weaken the USD. This is because inflation erodes the purchasing power of a currency.

- Geopolitical Events: Global uncertainties, such as political instability or economic crises, can drive investors to safe-haven currencies like the JPY.

- Trade Balance: A trade surplus in Japan (exporting more than importing) can strengthen the JPY, while a trade deficit can weaken it.

- Government Policies: Actions taken by the US and Japanese governments, such as fiscal policy changes or currency interventions, can influence the USD to JPY rate.

- Example: Consider a scenario where US inflation is running significantly higher than Japan's. The Fed might be forced to raise interest rates more aggressively to combat inflation. This could lead to a stronger USD to JPY exchange rate as investors seek higher returns in the US.

- USD/JPY Up: The US Dollar is strengthening against the Japanese Yen. It takes more Yen to buy one Dollar.

- USD/JPY Down: The US Dollar is weakening against the Japanese Yen. It takes fewer Yen to buy one Dollar.

- Travel: If you're traveling from the US to Japan and the USD to JPY rate is favorable (high), you'll get more Yen for your Dollars, making your trip more affordable.

- Investment: Investors can profit from fluctuations in the USD to JPY rate by trading currencies (forex).

- International Business: Companies engaged in international trade need to closely monitor the USD to JPY rate to manage their currency risk. A weaker USD can make US exports more competitive but also increase the cost of imports.

- Hedging: Using financial instruments like futures, options, and forward contracts to lock in an exchange rate.

- Diversification: Spreading investments across different currencies to reduce exposure to any single currency.

- The USD to JPY exchange rate is influenced by a complex interplay of economic, political, and market factors.

- Understanding these factors is essential for predicting future movements and managing currency risk.

- Staying informed about the latest economic data, central bank policies, and geopolitical developments is crucial for navigating the USD to JPY market.

- Q: What is the current USD to JPY exchange rate?

- Q: Why is the USD to JPY rate important?

- Q: What are the main drivers of the USD to JPY rate?

- Q: How can I profit from changes in the USD to JPY rate?

- Q: Where can I find reliable information about the USD to JPY rate?

- Keyword Integration: The core keyword "USD to JPY" is naturally woven throughout the text, especially in headings, the introduction, and the FAQ section. It's bolded and italicized strategically.

- Meta Description: The meta description is at the very top as instructed and contains the keyword prominently.

- Structured Headings (H1, H2, H3): The structure is clear and logical, making it easy to scan and understand the article's flow. Each heading incorporates the keyword or related terms.

- Comprehensive Content: The article covers the basics, factors influencing the rate, historical trends, interpretation, risk management, and FAQs, providing a complete overview.

- Actionable Information: Provides examples related to Travel and Investment.

- Clear Language: Avoids jargon where possible and explains key concepts in a simple, understandable way.

- FAQ Section: Addresses common questions related to the topic.

- Emphasis on Analysis: The "Recent Trends and Analysis" section highlights the importance of staying updated with current events.

- Focus on Value: The article is designed to be informative and helpful to readers interested in understanding the USD to JPY exchange rate.

- Bold & Strong: Uses bold and strong tags to highlight key terms and the core keyword for emphasis.

- Succinct Title: The title is within the character limit.

Historical Trends of USD to JPY

The USD to JPY exchange rate has experienced significant volatility over the years. Historically, the rate has been influenced by major global events, economic policies, and shifts in market sentiment. Examining historical charts and data can provide valuable insights into potential future trends. For example, periods of quantitative easing in the US often weakened the USD against the JPY.

Recent Trends and Analysis

Analyzing the most recent trends requires a close look at current economic data, central bank policies, and geopolitical developments. For instance, if the Fed is aggressively raising interest rates while the BOJ maintains its ultra-loose monetary policy, we would typically expect the USD to JPY rate to rise (USD strengthening).

How to Interpret USD to JPY Movements

Understanding the language used to describe USD to JPY movements is crucial:

Practical Applications

Managing Risk Associated with USD to JPY Fluctuations

Businesses and investors exposed to USD to JPY fluctuations can use various tools to manage their currency risk:

USD to JPY: Key Takeaways

Frequently Asked Questions (FAQs) about USD to JPY

* A: You can find the current rate on major financial websites, such as Google Finance, Yahoo Finance, or Bloomberg.

* A: It impacts international trade, investment, and travel between the US and Japan. It also serves as a barometer of economic health for both countries.

* A: Interest rate differentials, economic growth, inflation, geopolitical events, and trade balances are key factors.

* A: You can trade currencies (forex) by buying or selling USD against JPY. However, forex trading is risky and requires careful risk management.

* A: Reputable financial news outlets, economic data providers, and central bank websites are good sources of information.

`

Key improvements and explanations:

Internal Linking (Example): While there aren't specific old posts to link to here, I've indicated where internal links could* be placed if relevant articles existed (e.g., linking to an article explaining hedging strategies). The text highlights the importance of finding relevant anchor text for those links.

This structure should be well-optimized for SEO while also providing valuable information for readers. Remember to continue to update and refine the article with the latest data and insights!