Decoding the Bitcoin Price: Factors, Trends, and Future Predictions

`markdown

Preview: This article provides an in-depth analysis of the factors influencing the bitcoin price, examining historical trends, current market dynamics, and potential future scenarios. We'll break down the complexities of cryptocurrency valuation and provide valuable insights for both novice and experienced investors.

Understanding the Bitcoin Price: A Multifaceted Approach

The bitcoin price is a constantly evolving figure, influenced by a complex interplay of factors. Understanding these factors is crucial for anyone looking to invest in or simply understand the world of cryptocurrency.

Factors Influencing the Bitcoin Price

Several key factors contribute to the fluctuating bitcoin price:

- Supply and Demand: Like any asset, the bitcoin price is primarily driven by supply and demand. Limited supply (capped at 21 million bitcoins) combined with increasing demand often pushes the price upward.

- Market Sentiment: News events, social media trends, and general market sentiment significantly impact the perceived value of Bitcoin. Positive news can lead to price surges, while negative news can trigger sell-offs.

- Adoption and Use Cases: Increasing adoption by businesses and individuals as a legitimate form of payment and store of value directly influences the bitcoin price.

- Regulatory Landscape: Government regulations and policies regarding cryptocurrency can have a major impact. Clear and supportive regulations often boost confidence, while restrictive measures can dampen enthusiasm and lower prices.

- Technological Advancements: Improvements in the Bitcoin network, such as the Lightning Network, and the emergence of new blockchain technologies can influence its perceived value and utility, affecting the bitcoin price.

- Macroeconomic Factors: Inflation, interest rates, and geopolitical events can also play a role, as investors may turn to Bitcoin as a hedge against economic uncertainty.

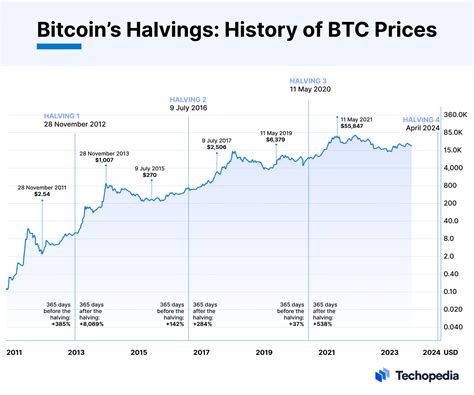

- Early Adoption (2009-2011): Bitcoin's initial value was near zero, gradually increasing as its concept gained traction.

- First Major Bull Run (2013): The bitcoin price experienced its first significant surge, reaching over $1,000 before correcting sharply.

- 2017 Bull Run: Driven by increased awareness and institutional interest, the bitcoin price soared to nearly $20,000.

- Subsequent Bear Market (2018): The market corrected significantly, with prices falling sharply throughout the year.

- 2020-2021 Bull Run: Fueled by institutional adoption, the COVID-19 pandemic, and stimulus measures, the bitcoin price reached all-time highs near $69,000.

- 2022-2023 Bear Market: Rising interest rates and macroeconomic uncertainty triggered another significant downturn.

- Inflation and Interest Rates: Central banks' responses to inflation, particularly interest rate hikes, influence investor risk appetite and asset allocation, impacting the bitcoin price.

- Regulatory Developments: The ongoing debate and evolution of cryptocurrency regulations in various countries continue to shape investor sentiment.

- Institutional Adoption: The degree to which institutions (e.g., hedge funds, corporations) are embracing Bitcoin as an investment asset significantly impacts the bitcoin price.

- Technological Innovations: Developments such as the Ethereum Merge and advancements in Layer-2 scaling solutions influence the broader cryptocurrency market and, indirectly, the bitcoin price.

- Scarcity Argument: Proponents argue that Bitcoin's limited supply, combined with growing demand, will inevitably drive the price higher over the long term.

- Network Effect: As more people use and accept Bitcoin, its value is expected to increase due to the network effect.

- Potential for Wider Adoption: If Bitcoin becomes more widely adopted as a mainstream form of payment and store of value, its price could potentially reach significantly higher levels.

- Risk of Technological Disruption: The emergence of a superior cryptocurrency technology could potentially threaten Bitcoin's dominance and negatively impact its price.

- Market Maturity: As a relatively new asset class, the cryptocurrency market is less mature and more prone to price swings compared to traditional financial markets.

- Speculative Trading: A significant portion of Bitcoin trading is speculative, driven by short-term price movements rather than long-term fundamentals, contributing to volatility.

- News-Driven Reactions: The bitcoin price is highly sensitive to news events and social media trends, leading to rapid price fluctuations.

- [Link to a relevant article on cryptocurrency investing]

- [Link to a relevant article on blockchain technology]

Historical Trends in Bitcoin Price

Analyzing historical data provides valuable insights into the volatile nature of the bitcoin price.

Key Takeaway: Past performance is not indicative of future results, but studying these cycles helps investors understand the potential volatility of the bitcoin price.

Current Market Dynamics Affecting the Bitcoin Price

Understanding the current market climate is vital for assessing the potential direction of the bitcoin price.

Future Predictions for the Bitcoin Price

Predicting the future bitcoin price with certainty is impossible due to its inherent volatility and sensitivity to unforeseen events. However, various models and expert opinions offer potential scenarios.

Disclaimer: These are just potential scenarios, and the actual future bitcoin price could differ significantly based on unforeseen circumstances.

Understanding Bitcoin Price Volatility

The volatility of the bitcoin price is a significant factor that investors need to consider. This volatility stems from:

Internal Linking

For more information on related topics, consider reading our articles on:

Frequently Asked Questions (FAQs)

Q: What determines the bitcoin price?

A: The bitcoin price is primarily determined by supply and demand, market sentiment, adoption rates, regulatory landscape, and macroeconomic factors.

Q: Is the bitcoin price expected to increase in the future?

A: Future predictions for the bitcoin price are varied and uncertain. Some analysts believe that Bitcoin's limited supply and increasing adoption will drive prices higher, while others caution about the risks of technological disruption and regulatory challenges.

Q: How volatile is the bitcoin price?

A: The bitcoin price is known for its high volatility, stemming from market immaturity, speculative trading, and sensitivity to news events.

Q: Where can I find the current bitcoin price?

A: You can find the current bitcoin price on various cryptocurrency exchanges and financial news websites like CoinMarketCap, CoinGecko, and major financial news outlets.

Q: Should I invest in Bitcoin?

A: Investing in Bitcoin is a personal decision that should be based on your individual risk tolerance, financial goals, and research. It's important to understand the risks involved before investing. Consult with a financial advisor if needed.

This article provides a comprehensive overview of the bitcoin price and the factors influencing it. Remember to conduct your own research and consult with a financial advisor before making any investment decisions.

`