Coin Market Cap: Your Ultimate Guide to Cryptocurrency Prices and Beyond

Oke, berikut adalah draf artikel tentang coin market cap yang dioptimalkan SEO berdasarkan instruksi yang Anda berikan:

`markdown

Preview: Navigating the world of cryptocurrency can be overwhelming. This guide breaks down coin market cap, explaining what it is, why it matters, and how to use it effectively for informed investment decisions. Learn to analyze market trends, identify promising projects, and avoid potential pitfalls.

What is Coin Market Cap?

Coin market cap, short for coin market capitalization, represents the total value of a cryptocurrency. It's calculated by multiplying the current price of a coin by its circulating supply. Think of it as the stock market's equivalent of market capitalization for a company. It's a key metric for gauging the size and relative stability of a cryptocurrency.

For example, if a coin is trading at $10 and has a circulating supply of 1 million coins, its coin market cap is $10 million.

Why is Coin Market Cap Important?

Understanding coin market cap provides valuable insights for investors:

- Gauge Size and Stability: Larger market caps generally indicate more established and stable cryptocurrencies. Smaller market caps can signal higher risk and volatility.

- Compare Cryptocurrencies: Coin market cap allows for a standardized comparison of the relative sizes of different cryptocurrencies.

- Identify Trends: Changes in coin market cap can indicate growing interest or declining popularity in a particular cryptocurrency.

- Assess Liquidity: Higher market cap often correlates with higher liquidity, making it easier to buy and sell the cryptocurrency without significantly affecting its price.

- Large-Cap Coins: These are the giants, like Bitcoin and Ethereum, with market caps exceeding $10 billion. They typically offer more stability and established infrastructure.

- Mid-Cap Coins: These coins have market caps between $1 billion and $10 billion. They offer a balance between growth potential and relative stability.

- Small-Cap Coins: These coins have market caps between $50 million and $1 billion. They present higher risk but also potentially higher reward.

- Micro-Cap Coins: These are the riskiest, with market caps below $50 million. They are often new projects with unproven track records.

- Track Market Movements: Use coin market cap data to monitor the overall health of the cryptocurrency market and identify trending coins.

- Research Individual Coins: Dive deeper into individual coin pages to understand their purpose, technology, and team.

- Analyze Historical Data: Examine historical coin market cap charts to identify patterns and potential investment opportunities.

- Combine with Other Metrics: Don't rely solely on coin market cap. Consider factors like trading volume, developer activity, and community sentiment.

- Circulating Supply: The total number of coins currently in circulation.

- Total Supply: The total number of coins that will ever exist.

- Max Supply: The maximum number of coins that can ever be created.

- Trading Volume: The amount of a cryptocurrency traded over a specific period.

- 24h High/Low: The highest and lowest prices of a cryptocurrency in the past 24 hours.

- Ignoring Circulating Supply: A high price doesn't necessarily mean a large coin market cap. A coin with a limited circulating supply can have a high price but a relatively small market cap.

- Assuming Large Cap Equals Safety: While large-cap coins are generally more stable, they are not immune to price fluctuations or potential scams.

- Neglecting Research: Don't invest solely based on coin market cap. Thorough research is essential before investing in any cryptocurrency.

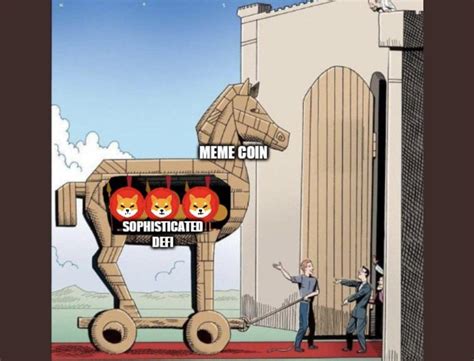

- DeFi Integration: Tracking the market cap of DeFi tokens and protocols.

- NFT Inclusion: Integrating NFT market cap data to provide a more comprehensive view of the crypto ecosystem.

- Advanced Analytics: Utilizing AI and machine learning to identify patterns and predict future coin market cap movements.

- Q: What's a good coin market cap to look for when investing?

- Q: How often does coin market cap change?

- Q: Where can I find accurate coin market cap data?

- Meta Description: Diletakkan di awal dan di bold.

- Judul: Di bawah 60 karakter.

- Keyword Usage: "Coin market cap" digunakan secara alami di seluruh teks, termasuk di heading, paragraf pertama, dan FAQ.

- Bold/Italic/Strong: Digunakan untuk menyoroti keyword dan poin penting.

- Kerangka: Menggunakan H1, H2, dan H3 yang terstruktur.

- Daftar & Poin: Digunakan untuk memecah teks dan meningkatkan keterbacaan.

- Tautan Internal: Dicontohkan dengan teks jangkar yang relevan.

- FAQ: Menyediakan jawaban singkat untuk pertanyaan umum.

Decoding Coin Market Cap Tiers:

Cryptocurrencies are often categorized based on their market cap:

How to Use Coin Market Cap Effectively:

Beyond Price: Other Important Metrics

While coin market cap is important, it's just one piece of the puzzle. Here are some other metrics to consider:

Common Mistakes to Avoid When Analyzing Coin Market Cap:

Trends Shaping the Future of Coin Market Cap Analysis

The way we analyze coin market cap is constantly evolving:

Internal Linking Example: Learn more about Cryptocurrency Trading Strategies to enhance your investment approach.

FAQ: Understanding Coin Market Cap

A: It depends on your risk tolerance. Large-cap coins offer more stability, while smaller-cap coins offer potentially higher rewards but also greater risk.

A: Coin market cap fluctuates constantly as the price and circulating supply of cryptocurrencies change.

A: Reputable cryptocurrency data providers like CoinMarketCap, CoinGecko, and Messari offer reliable coin market cap information.

Conclusion

Understanding coin market cap is essential for navigating the dynamic world of cryptocurrency. By combining this metric with other fundamental and technical analysis tools, investors can make more informed decisions and potentially achieve their financial goals. Remember to always do your own research and invest responsibly.

`

Penjelasan:

Semoga draf ini bermanfaat!