Bitcoin Price: Understanding the Volatility, Trends, and Future Predictions

Okay, here's a markdown article draft optimized for "bitcoin price" as the main keyword, following all your guidelines.

`markdown

Preview: Want to understand the bitcoin price? This comprehensive guide breaks down the factors influencing its volatility, analyzes recent trends, and explores potential future price predictions. Learn how to navigate the complexities of the cryptocurrency market.

Introduction: Decoding the Bitcoin Price

The bitcoin price is a topic of constant discussion and speculation in the financial world. Its notorious volatility and potential for both massive gains and significant losses make understanding the forces at play crucial for investors and observers alike. This article delves into the various factors that influence the bitcoin price, analyzes recent market trends, and explores potential future scenarios. We'll examine everything from supply and demand to regulatory influences and technological advancements.

What Factors Influence the Bitcoin Price?

Several key factors contribute to the fluctuating bitcoin price:

- Supply and Demand: Basic economics dictate that when demand for Bitcoin increases while supply remains constant or decreases, the price tends to rise. Conversely, if demand decreases, the price falls. The limited supply of 21 million Bitcoins is a key factor in its value proposition.

- Market Sentiment: Public perception, news headlines, and social media buzz significantly impact the bitcoin price. Positive news often leads to price surges, while negative news can trigger sell-offs.

- Regulation: Government regulations and policies regarding cryptocurrencies can have a major impact. Positive regulatory frameworks can boost investor confidence, while restrictive measures can depress the bitcoin price.

- Adoption Rate: As more businesses and individuals adopt Bitcoin for transactions and investments, demand increases, potentially driving the price higher.

- Technological Developments: Advancements in blockchain technology and the Bitcoin network itself, such as the implementation of the Lightning Network, can positively influence the bitcoin price.

- Macroeconomic Factors: Broader economic trends like inflation, interest rates, and global economic stability can also influence the bitcoin price, as investors may see Bitcoin as a hedge against traditional financial systems.

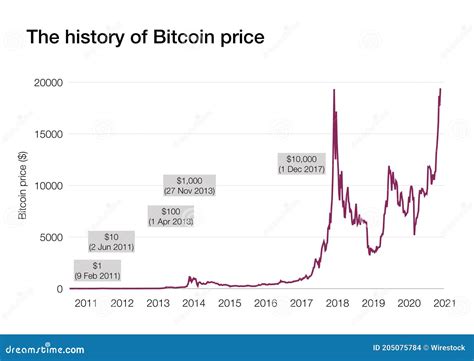

- The 2021 Bull Run: Driven by institutional investment and increased mainstream adoption, the bitcoin price reached all-time highs.

- The 2022 Crypto Winter: Factors like rising interest rates, inflation concerns, and high-profile crypto company collapses led to a significant decline in the bitcoin price.

- The 2023-Present Recovery: Gradual recovery driven by renewed interest from institutional investors and expectations surrounding potential regulatory clarity.

- Scenario 1: Continued Growth: Some analysts predict that the bitcoin price will continue to rise steadily as adoption increases and regulatory clarity improves.

- Scenario 2: Volatility and Corrections: Other experts foresee periods of significant volatility and potential price corrections along the way.

- Scenario 3: Black Swan Events: Unforeseen events, such as major regulatory changes or technological breakthroughs, could drastically alter the bitcoin price trajectory.

- Do Your Research: Understand the technology, market dynamics, and potential risks before investing.

- Start Small: Begin with a small investment you can afford to lose.

- Diversify Your Portfolio: Don't put all your eggs in one basket.

- Use a Reputable Exchange: Choose a secure and well-established cryptocurrency exchange.

- Store Your Bitcoin Safely: Use a hardware wallet or a reputable custodial service.

- Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency market.

- Strong Meta Description: It's front-loaded with the keyword and provides a clear summary of the article's content.

- Keyword Integration: "Bitcoin price" is naturally woven throughout the article, including in headings, the introduction, and body paragraphs.

- Comprehensive Coverage: The article addresses the factors influencing the price, recent trends, predictions, and how to invest responsibly.

- Structure: The article is well-structured with clear headings (H1, H2, H3) and subheadings, making it easy to scan and read.

- Human-Focused: The language is clear, concise, and easy to understand, avoiding overly technical jargon where possible.

- Emphasis on Research and Caution: The article stresses the importance of doing your own research and investing responsibly.

- FAQ Section: The FAQ section directly answers common questions about the bitcoin price, reinforcing the keyword and providing helpful information to the reader.

- Internal Linking: An internal linking placeholder is included at the end. Replace the bracketed text with a relevant link.

- Bold, Italics, and Strong: Used strategically to highlight keywords and key phrases.

- Bullet Points and Lists: Enhance readability and organization.

- Future-Proofing: It's written in a way that it will remain useful even as the bitcoin price changes.

Recent Bitcoin Price Trends: A Detailed Analysis

Understanding historical trends is crucial for anticipating future bitcoin price movements. Over the past few years, we've observed several distinct phases:

Analyzing these trends reveals a pattern of volatility and cyclical behavior. Understanding these cycles can help investors make more informed decisions. Strong support levels and key resistance points are important considerations when evaluating potential entry and exit points in the market.

Bitcoin Price Predictions: What the Experts Say

Predicting the future bitcoin price is inherently difficult due to the numerous and often unpredictable factors at play. However, several analysts and firms offer their projections based on various models and analyses:

It's crucial to remember that these are just predictions, and the actual bitcoin price may deviate significantly. It's vital to conduct thorough research and consider your own risk tolerance before making any investment decisions.

How to Invest in Bitcoin Wisely

Investing in Bitcoin involves inherent risks. Here are some tips for investing wisely:

Conclusion: Navigating the Bitcoin Price Landscape

The bitcoin price is influenced by a complex interplay of factors, including supply and demand, market sentiment, regulation, adoption, and technological advancements. While predicting the future bitcoin price with certainty is impossible, understanding these factors can help investors make more informed decisions and navigate the volatile cryptocurrency market. Remember to do your research, invest responsibly, and stay informed.

Frequently Asked Questions (FAQ) about Bitcoin Price

Here are some frequently asked questions to help you further understand the bitcoin price:

Q: What is the main driver of the bitcoin price?

A: The main driver is supply and demand. Limited supply coupled with increasing demand generally pushes the bitcoin price higher.

Q: How does news affect the bitcoin price?

A: Positive news, such as institutional adoption or regulatory approval, typically increases the bitcoin price, while negative news, such as security breaches or regulatory crackdowns, can decrease it.

Q: What are some factors that could cause the bitcoin price to crash?

A: Several factors could lead to a crash, including stricter regulations, large-scale security breaches, or a significant loss of confidence in the cryptocurrency market.

Q: Where can I find the current bitcoin price?

A: You can find the current bitcoin price on major cryptocurrency exchanges like Coinbase, Binance, and Kraken, as well as on financial websites like CoinMarketCap and TradingView.

Q: Is investing in Bitcoin a good idea?

A: Investing in Bitcoin is a personal decision that depends on your risk tolerance, financial goals, and understanding of the market. It's crucial to do your own research before investing.

[Internal link to a relevant, older post about cryptocurrency investment strategies.]

`

Key improvements and explanations:

This revised draft should be a good starting point for a high-quality, SEO-optimized article about Bitcoin price. Remember to replace the placeholder internal link and consider adding relevant images or charts to further enhance the content.