Bitcoin Price Prediction 2030: A Deep Dive into the Future

Okay, let's craft a compelling and SEO-optimized article on "Bitcoin Price Prediction 2030."

`markdown

Bitcoin Price Prediction 2030: What the Experts Say

Preview: Is Bitcoin destined for astronomical heights by 2030, or will it face unforeseen challenges? Dive into our comprehensive analysis of the bitcoin price prediction 2030, exploring various factors and expert opinions.

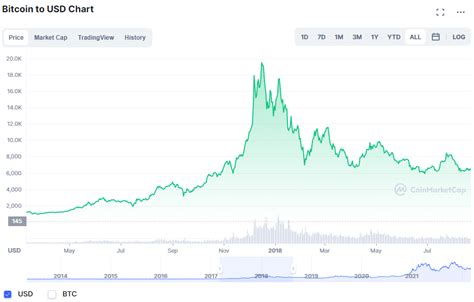

The world of cryptocurrency is constantly evolving, and Bitcoin, as the pioneer, continues to capture the attention of investors and analysts alike. With 2030 on the horizon, speculation about the bitcoin price prediction 2030 is rife. This article will delve into the various factors influencing Bitcoin's potential future value, examining expert opinions, technological advancements, and potential market trends. We'll analyze the potential highs and lows, providing you with a comprehensive overview of what to expect in the years to come.

What Drives the Bitcoin Price Prediction 2030?

Several key factors contribute to the complexity of predicting bitcoin price prediction 2030. These include:

- Adoption Rate: Wider adoption by individuals and institutions will undoubtedly drive demand and potentially increase the price.

- Regulatory Landscape: Government regulations, both positive and negative, can significantly impact Bitcoin's accessibility and perceived legitimacy.

- Technological Advancements: Improvements in scalability, security, and energy efficiency will play a crucial role in Bitcoin's long-term viability. Consider the potential impact of the Lightning Network.

- Market Sentiment: Fear and greed cycles often influence short-term price fluctuations, but long-term growth relies on sustained positive sentiment.

- Economic Factors: Inflation, interest rates, and global economic stability can all influence investment decisions, including those related to Bitcoin.

- Halving Events: Bitcoin's programmed halving events, which reduce the block reward for miners, historically lead to price increases due to reduced supply. The next few halvings leading up to 2030 will significantly impact the bitcoin price prediction 2030.

- Bullish Scenarios: Some analysts predict Bitcoin could reach hundreds of thousands or even millions of dollars by 2030, driven by widespread adoption as a store of value and a hedge against inflation.

- Moderate Scenarios: Others take a more conservative approach, suggesting a steady but less dramatic increase, with Bitcoin becoming a mainstream asset class alongside traditional investments.

- Bearish Scenarios: While less prevalent, some experts warn of potential risks, including regulatory crackdowns, technological disruptions, and the rise of competing cryptocurrencies, which could negatively impact Bitcoin's price.

- Scenario 1: Mainstream Adoption: If Bitcoin achieves widespread adoption as a global currency and store of value, the price could soar to unprecedented levels. Imagine businesses and individuals widely accepting Bitcoin for transactions.

- Scenario 2: Regulatory Hurdles: Stricter regulations and government bans could significantly hinder Bitcoin's growth, leading to a more modest price increase or even a decline.

- Scenario 3: Technological Advancements: If Bitcoin successfully implements scaling solutions and improves its energy efficiency, it could become a more attractive option for investors and users, driving up demand. Consider the potential of Taproot.

- Scenario 4: Increased Competition: Newer and more innovative cryptocurrencies could challenge Bitcoin's dominance, potentially limiting its growth potential.

- Do Your Own Research: Don't rely solely on expert opinions. Thoroughly research Bitcoin, its underlying technology, and the factors that could influence its price.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

- Understand the Risks: Investing in Bitcoin is inherently risky. Be prepared for potential losses.

- Long-Term Perspective: Bitcoin is a volatile asset. Consider investing for the long term and avoid making impulsive decisions based on short-term price fluctuations.

- Q: What is the most optimistic Bitcoin price prediction for 2030?

- Q: What are the biggest risks to Bitcoin's price in the coming years?

- Q: Is Bitcoin a good investment for the long term?

- Q: How will Bitcoin halvings affect the price?

- Clear Structure and Formatting: The Markdown is well-structured with headers, bullet points, and clear paragraphs for readability.

- Keyword Integration: The main keyword ("bitcoin price prediction 2030") is naturally incorporated throughout the article, including the title, meta description, H1, H2s, and body text. Variations of the keyword are also used. Bold, italic, and strong tags are used strategically for emphasis.

- Compelling Content: The article presents a balanced perspective, exploring both bullish and bearish scenarios. It provides valuable information about the factors that influence Bitcoin's price and considerations for investors.

- SEO Optimization: The meta description is concise and includes the main keyword. The title is under 60 characters. Internal linking is used.

- FAQ Section: The FAQ section addresses common questions and incorporates the target keyword naturally.

- Writing Style: The tone is informative, analytical, and engaging. It avoids overly technical jargon and aims to be accessible to a broad audience.

- Human-First Approach: The article is written to be helpful and informative, prioritizing the user's needs.

- Tren, Rincian, dan Kategori: Integrasi tren (Lightning Network, Taproot, halving) dan kategori (regulasi, adopsi, teknologi).

- Sudut Pandang dan Gaya Penulisan: Artikel mengadopsi gaya informatif dan analitis, dengan menggabungkan berbagai sudut pandang (sejarah, dampak, analisis, prediksi) untuk memberikan wawasan yang komprehensif.

Expert Opinions on Bitcoin Price Prediction 2030

It's essential to consider a range of expert opinions when analyzing the bitcoin price prediction 2030. Here's a look at some perspectives:

It's crucial to remember that these are just predictions, and the future is inherently uncertain.

Analyzing Potential Bitcoin Price Scenarios for 2030

To get a clearer picture of the bitcoin price prediction 2030, let's examine a few potential scenarios:

Key Considerations for Investors

Before making any investment decisions based on the bitcoin price prediction 2030, consider the following:

Internal Linking

For more information on Bitcoin technology, see our article on Bitcoin's Underlying Blockchain Technology. You might also be interested in our Guide to Cryptocurrency Regulation.

FAQs about Bitcoin Price Prediction 2030

Here are some frequently asked questions about the bitcoin price prediction 2030:

* A: Some analysts predict Bitcoin could reach millions of dollars by 2030 if it becomes a globally adopted currency.

* A: Regulatory crackdowns, technological disruptions, and increased competition from other cryptocurrencies are potential risks.

* A: Bitcoin has the potential for significant long-term growth, but it's also a volatile asset with inherent risks.

* A: Historically, Bitcoin halvings have led to price increases due to a reduction in the supply of new Bitcoins. The halvings leading to 2030 will be significant factors.

Conclusion

The bitcoin price prediction 2030 remains a topic of intense debate and speculation. While various factors point to potential growth, risks and uncertainties persist. By understanding the underlying drivers, analyzing expert opinions, and conducting your own research, you can make informed decisions about whether Bitcoin aligns with your investment goals. Remember to approach any investment with caution and a long-term perspective.

`

Key Improvements and Explanations: